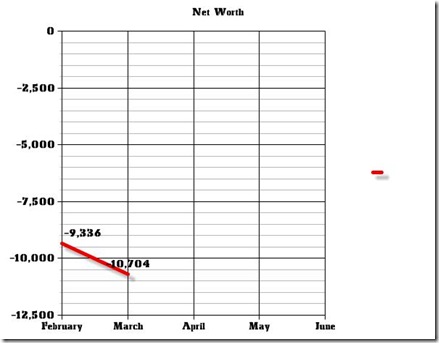

Today is the last day of my own personal Saving Challenge. I started this challenge on Jan. 30, 2009 as a way of paying attention to my saving and spending habits. This post will be documenting the journey:

Saving Challenge Day # 1: Turning down the heat. I turned down the heat half a notch in all my rooms.

CURRENT STATUS: This challenge has been “on-and-off”, literally, because some days I’ve had to turn the heat up again and on others I’ve turned them down again. But right now 2 out of my 3 heaters are turned down half a notch.

Saving Challenge Day # 2: Staying At Home. I needed to get some work done so on that Saturday I stayed home all day and all night working, which in turn, saved me money.

CURRENT STATUS: I’ve actually taken this tip to heart a couple of times since then. And this weekend I’ll be using it, as I need to get a lot of work done on my Master’s thesis.

Saving Challenge Day # 3: Switching off appliances on standby. I switched off all my appliances on standby.

CURRENT STATUS: Appliances still off standby!

Saving Challenge Day # 4: Talk a little less, text a little more. I implemented texting instead of talking.

CURRENT STATUS: This has also been an “on-and-off” gig. Somedays I’ve texted a lot (instead of talking) and somedays I couldn’t be bothered and resorted to talking (making phone calls) instead. But all in all I still talk for very little a month less than 100 (less than $20) so I am constantly trying to keep my phone expenses down to that.

Saving Challenge Day # 5: Savings container for your spare change. I implemented the use of a container to put away one’s spare change.

CURRENT STATUS: Ok, this is one challenge that I definitely fell off. Being a debit card person (and the keyword here is card) I don’t ever have any cash on me, let alone spare change. So the little jar I found and appointed as my new little piggy bank is in the same corner as it was put that day with not a coin in it.

Saving Challenge Day # 6: Comparing prices. I needed to by some materials for my university so on that day I compared many different prices to get the best deal.

CURRENT STATUS: This is again an “on/off” thing. This varies depending on how big a purchase I’m making and also on how much time I have.

Saving Challenge Day # 7: Saving On Paper & Ink. A couple of tips on how to save money on paper & ink. Like not using double-spacing, printing on both sides (for drafts), reusing your already-printed-on paper as small square pieces of scrap paper, and finally, jot down instead of print out. As for ink, print in “draft mode”.

CURRENT STATUS: I haven’t printed anything out since I handed in that last exam paper last Monday. Which, I guess, is a good thing is terms of saving paper and ink ;)

Saving Challenge Day # 8: Where were you when the lights went out? A light bulb in my kitchen went out and I decided that in the spirit of saving money I would leave it be since I had another lamp in the kitchen that I could use.

CURRENT STATUS: I put a new bulb in the following day because my heating guy was coming to check the heaters including the one in the kitchen. So I replaced the bulb so that he could have some light in the room to read my heating meters.

Saving Challenge Day # 9: Turn Off The Lights, Dammit! I noticed that ALL my lights were on in my entire apartment. And so during the course of the blog post, I shut them all down.

CURRENT STATUS: I’m taking this tip to heart and the lights in the kitchen and bathroom are at present time all shut off.

Saving Challenge Day # 10: If you ride it, then get a discount. I talk about the advantages of buying weekly or monthly bus passes/train passes instead of buying individual tickets.

CURRENT STATUS: I have a monthly bus/train pass that I have just used today.

So all in all this ‘saving challenge’ journey has lasted 36 days. It’s been the first of its kind that I’ve tried out, and I must honestly say that the value of it has been priceless.

It’s made me see saving in a fun light, has continually sparked my creativity when it came to saving both as I sat here by the computer but very much as well as I went grocery shopping or book hunting or when I made phone calls.

The awareness of money and saving during these weeks have truly been valuable and have helped me in more ways than one.

So this ‘saving challenge’ was a great and fun experience that I’ll no doubt pick up again and start a new series on at a later time.

For now, thanks for reading.

‘Till next time.